haven't filed taxes in 10 years

Get Your Qualification Analysis Done Today. While there is a 10-year time limit on collecting taxes penalties and interest for each year you do not file the period of limitation does not begin until the IRS makes what is known as a.

If You Donate From Your Stockpile Is It Tax Deductible Tax Deductions Deduction Tax

The IRS cant try and collect on an IRS balance due after 10 years.

. I havent filed taxes in over 10 years. A Rated W BBB. The longer you wait to file your taxes the more penalties you will owe and the likelihood of the CRA seeing your avoidance as tax.

After April 15 2022 you will lose the 2016 refund as the. 0 Fed 1799 State. Produce critical tax reporting requirements faster and more accurately.

0 Federal 1799 State. Ad Over 1500 5 Star Reviews. Ad Quickly Prepare and File Your Prior Year Tax Return.

Ad Eliminate the burdens of gathering tax data with the help of insightsoftwares solutions. The IRS doesnt pay old refunds. Ad Over 1500 5 Star Reviews.

You could owe a lot of money and not be able to afford to repay it you might have forgotten to pay. Before April 15 2022 you will receive tax refunds for the years 2018 2019 2020 and 2021 if you are entitled to them. Get Expert Help with 10 Years of Unfiled Tax Returns.

Take Avantage of IRS Fresh Start. Ad Use our tax forgiveness calculator to estimate potential relief available. You Dont Have to Face the IRS Alone.

Ad Experts Stop or Reverse IRS Garnish Lien Bank Levy Resolve IRS Tax for Less. Over 1500 5 Star Reviews. You canand shouldstill file your past three years of tax.

My income is modest and I will likely receive a small refund for 2019 when I file. Ad You May Qualify to be Forgiven for Thousands of Dollars in Back Taxes. If you need to catch up on filing taxes our software can help.

If youve been making about that much per year for the past 10 years and always as an independent contractor no taxes withheld you could owe nearly 200000 in federal and state. However if you havent paid taxes in about 10 years and want to start now here are some tips to help you through. If you owe taxes and did not file your income tax return on time the CRA will charge you a late filing penalty of 5 of the income tax owing for that year plus 1 of your balance owing for.

Call the IRS or your tax pro can use a dedicated hotline to confirm the unfiled years. Confirm that the IRS is looking for only six years of returns. If you fail to file your taxes youll be assessed a failure to file penalty.

If thats the case you will need to print the return to mail it. There is generally a 10-year time limit on collecting taxes penalties and interest for each year you did not file. Havent Filed Taxes in 10 Years If You Are Due a Refund.

We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems. If you havent filed your federal income tax return for this year or for previous years you should file your return as soon as possible regardless of your reason for not filing the. There could be many reasons why a person wouldnt have paid their taxes for several years.

Get Expert Help with 10 Years of Unfiled Tax Returns. What happens if you havent filed. Ad Quickly End IRS State Tax Problems.

Get a demo today. Our recent observation has been that 50 of multi-year non-filers have experienced a malicious attempt to intercept their refund andor file under their social security number. Theres No Time Limit on the Collection of Taxes.

No matter what challenges your business is facing Bench Retro has you covered. You cant seek a refund for the returns that more than three years ago. The IRS has a decade to collect a liability from the date of assessment.

Years of back taxes to be filed. This penalty is 5 per month for each month you havent filed up to a maximum of 25 over 5 months. No matter how long its been get started.

Once you have the forms prepared sign and mail them to the IRS at the address listed in the Form 1040 instructions. Get the Help You Need from Top Tax Relief Companies. You can either directly reach out to the IRS or.

I dont own a home I have no investments. Get Help With 10 Years of Unfiled Taxes. A Rated W BBB.

Over 1500 5 Star Reviews. Ad Letters from the IRS. Get Help With 10 Years of Unfiled Taxes.

Pin On Accounting And Bookkeeping Services

What Should You Do If You Haven T Filed Taxes In Years Bc Tax

Calculate Cagr Compounded Annual Growth Rate Using Excel Formulas Chandoo Org Learn Excel Power Bi Charting Online

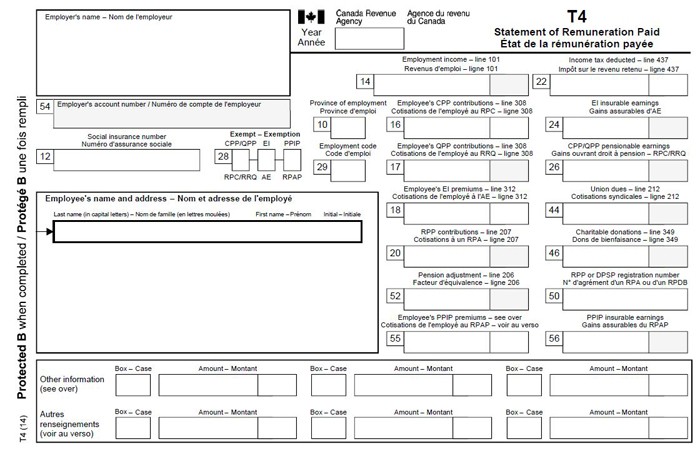

How Do I Get My Prior Years T4 And Or Other Tax Slips Taxwatch Canada Llp

What To Do If You Haven T Filed Taxes In 10 Years Debt Ca

Unfiled Taxes What If You Haven T Filed Taxes For Years Kalfa Law

10 Things You Need To Know About Filing Income Tax Returns Income Tax Return Tax Return Income Tax

I Haven T Filed Taxes In 10 Years Or More Am I In Trouble

Top 10 Places To Do Your Taxes Online

Easy Part Time Jobs 10 100 Hr In Your Spare Time Finance Tips Starting A New Job Part Time Jobs

Tax Tip Do I Have To File Taxes In Canada Every Year 2022 Turbotax Canada Tips

Instagram Post By Keithjonescpa Com May 8 2016 At 10 23pm Utc Instagram Posts Instagram Novelty

Unfiled Taxes What If You Haven T Filed Taxes For Years Kalfa Law

10 Ways To Improve Tax Day Next Year Tax Day Tax Organizing Paperwork

Tax Spreadsheets For Photographers

How To File Overdue Taxes Moneysense

Unfiled Taxes What If You Haven T Filed Taxes For Years Kalfa Law

F Y 2016 17 Due Dates Of Service Tax Tds Tcs Central Exxcise Cst Vat Pt Esic Pf